st louis county sales tax 2020

What to Expect. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

![]()

Performance Management And Budget St Louis County Website

The Missouri state sales tax rate is currently.

. While many counties do levy a countywide sales tax St Louis County does not. The sales tax jurisdiction name. The minimum combined 2022 sales tax rate for St Louis County Minnesota is.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Get 1st Month Free.

What is the sales tax rate in Saint Louis Missouri. Monday - Friday 8 AM - 5 PM. Tax-forfeited land managed and offered for sale by St.

CAN PTL MAY 8 2019. 2019 Prop P Reports. 15 baths 1122 sq.

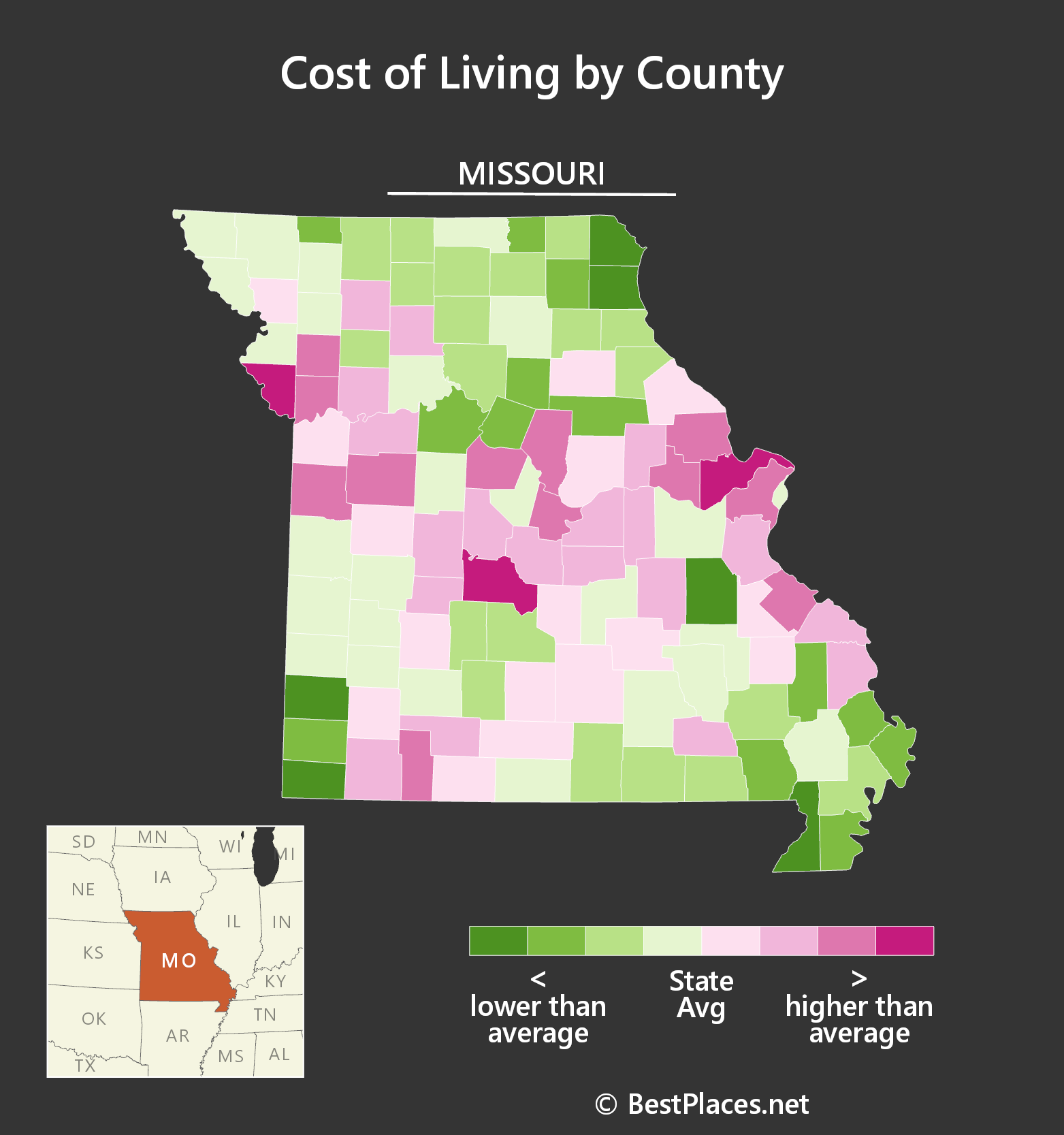

41 South Central Avenue Clayton MO 63105. Louis County Missouri Tax Rates 2020. The Minnesota sales tax of 6875 applies countywide.

Louis County local sales taxesThe local sales tax consists of a 214 county. The December 2020 total local sales tax rate was 7613. Louis County Board enacted.

This file is second of three data sets used to produced the Change of. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. This is the total of state and county sales tax rates.

This is the total of state county and city sales tax rates. St louis county sales tax 2021. Stress Free Hassle Free Sales Tax.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. 2020 Prop P Reports. Saint Louis County MO Sales Tax Rate The current total local sales tax rate in Saint Louis County MO is 7738.

Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. County Sales Tax information registration support. Condo located at 2020 Washington Ave 507 St.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of. View sales history tax history home value estimates and overhead. St Louis County Has No County-Level Sales Tax.

The combined rate used in this. There is no applicable county tax or special tax. 2018 Prop P Reports.

The St Louis County Sales Tax is 2263. NO LAND TAX SALE. Land Tax sales are held 5 times in 2022.

This is the total of state and county sales tax rates. Acquiring property through the Sheriffs land tax sale may be highly technical and complicated. Louis County Public Safety Sales Tax Quarterly Report 2020 Quarter 4 Beginning.

Louis MO 63103 sold for 138000 on Nov 16 2018. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd.

Get Your First Month Free. Sales Tax Table For St. This is the total of state and county sales tax rates.

A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. We strenuously suggest that you consult an attorney before bidding. What is the sales tax rate in St Louis County.

The December 2020 total local sales tax rate was also 9679. Ad Put Your Sales Tax On Autopilot. Louis County Missouri Tax Rates 2020.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 873 in St. The minimum combined 2022 sales tax rate for Saint Louis Missouri is. Potential Tax Liability Summary data file Part 2 of 3 opendata_stlco.

Ad New State Sales Tax Registration.

Print Tax Receipts St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

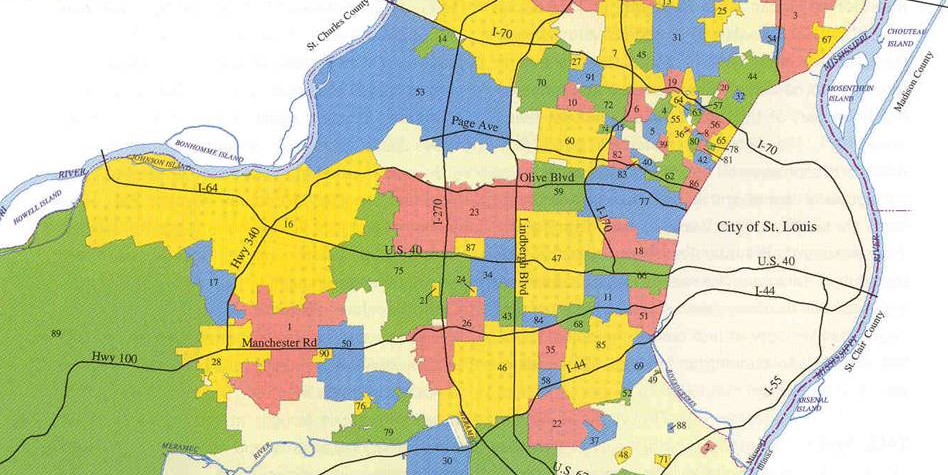

Let It Go Time To Disincorporate Municipalities In St Louis County Nextstl

Top Senior Friendly Activities In St Louis Missouri

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

St Louis Board Of Aldermen Approve New 14 Ward Map Fox 2

![]()

Performance Management And Budget St Louis County Website

Missouri Sales Tax Rates By City County 2022

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

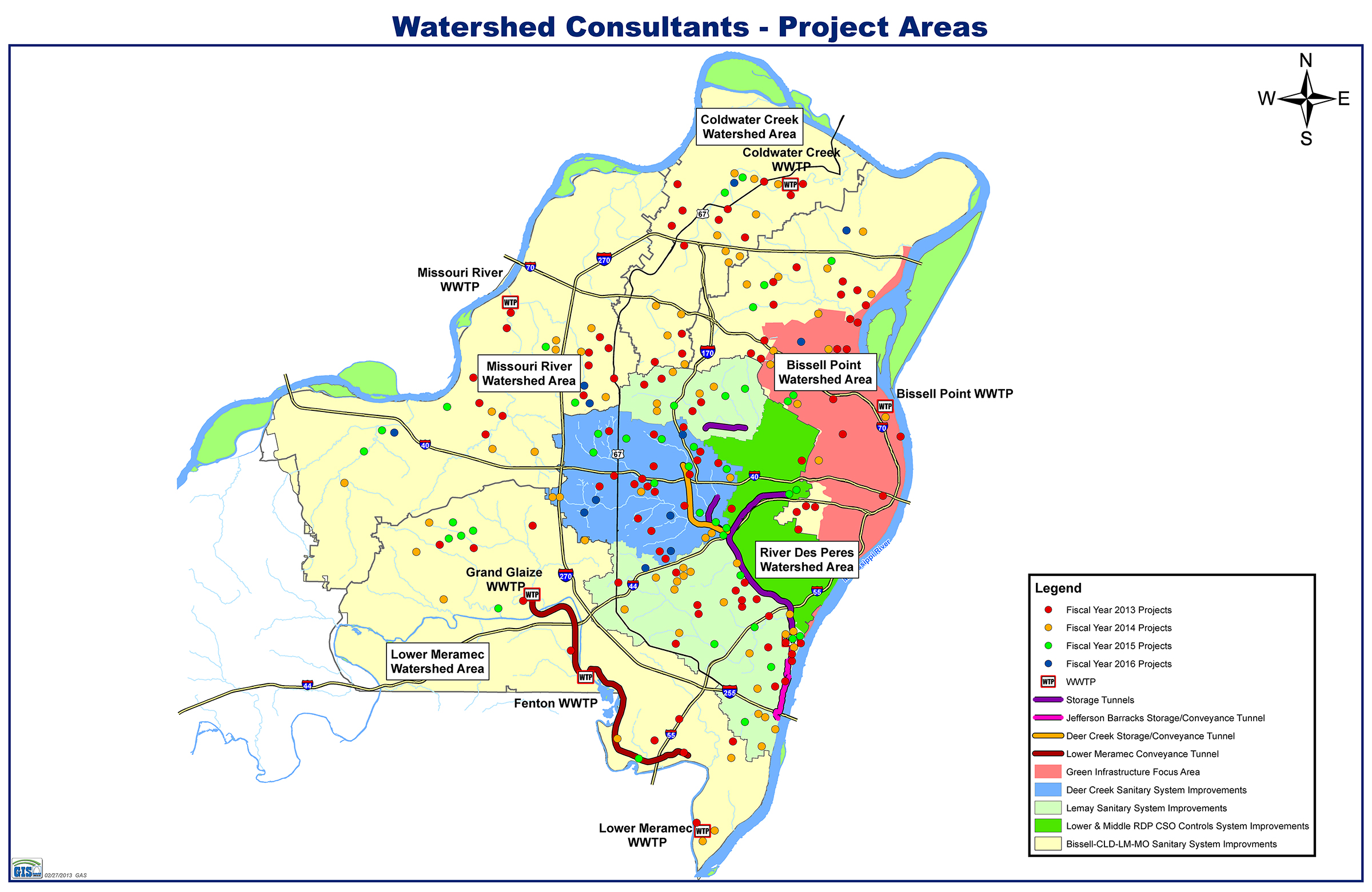

Watershed Map Information Metropolitan St Louis Sewer District